Morning Brief

Headline News:

The S&P 500 futures are down 5 points and are trading 0.1% below fair value. The Nasdaq 100 futures are down 36 points and are trading 0.5% above/below fair value. The Dow Jones Industrial Average futures are up 49 points and are trading 0.2% above fair value.

Early action is mixed with better-than-expected earnings in Dow component American Express (AXP ), helping to offset some weakness seen after yesterday’s close in the wake of earnings disappointments from several companies, namely Snap (SNAP ) and Seagate Tech (STX ). The former reported above-consensus earnings but did not provide Q3 guidance, citing uncertainties related to the operating environment as the reason. The latter reported weaker-than-expected earnings and revenue while issuing downside guidance and also warned of weakening global economic conditions.

There was also economic data out overnight, which points to the weakening global economic conditions. Preliminary July PMI data from Japan, Australia, France, and Germany all showed weaker-than-expected results. This comes ahead of the July preliminary IHS Markit PMI at 9:45 a.m. ET.

Sovereign bond markets rallied as the slowdown narrative picks up steam following the weaker-than-expected PMI reports.

CNN reported that the Senate is expected to pass the CHIPS semiconductor manufacturing bill as soon as next week.

WTI crude oil futures are down 1.0% to $95.45/bbl. Natural gas futures are down 0.4% to $7.79/mmbtu. Unleaded gasoline futures are down 1.2% to $3.11/gal.

The 2-yr Treasury note yield is down nine basis points to 3.00%, and the 10-yr note yield is down 11 basis points to 2.80%.

(Michael Gibbs, Director of Equity Portfolio & Technical Strategy)

Markets:

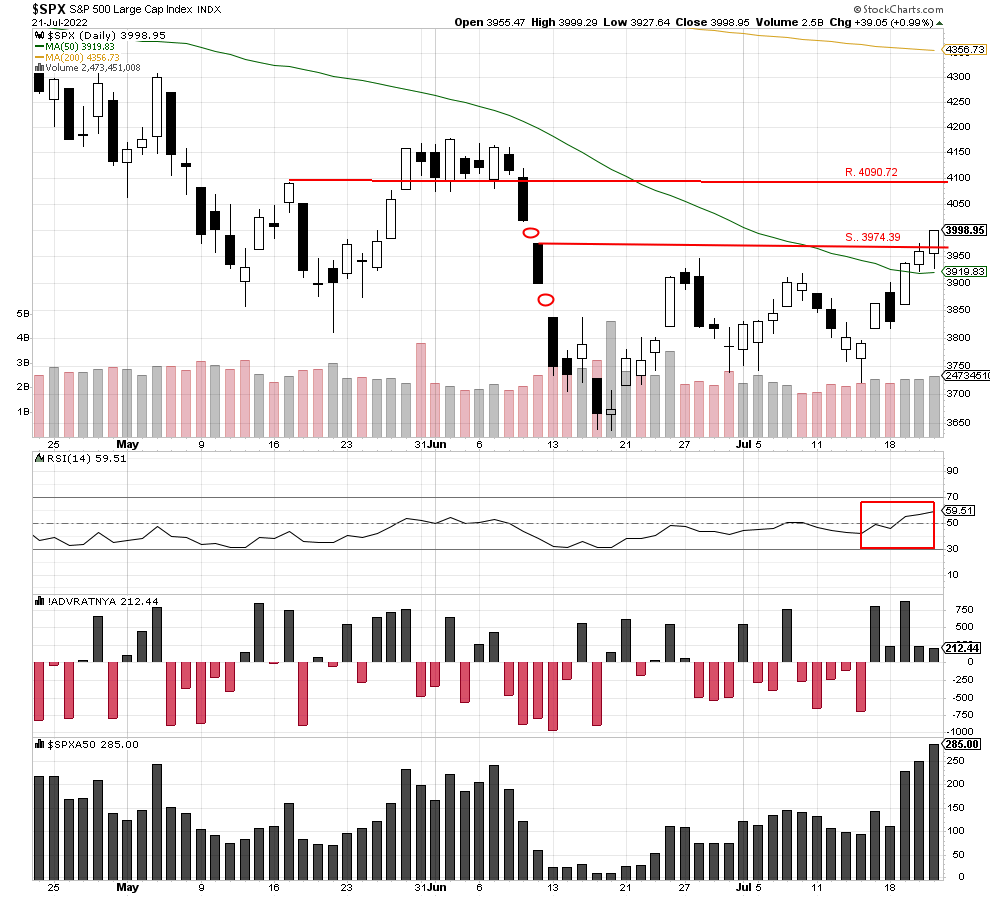

The S&P 500 rallied for the third day, closing at 3998.95 and above resistance at 3974.39. The index has now moved well past the 50-day moving average on rising volume. RSI has moved higher, with the index closing at another high for the month at 59.51.

We could see some profit taking before the weekend, but if sellers come in, we feel the support at 3974.39 will hold. Also, if the index can close above 4017.17, it will fill another down gap which would be bullish for the uptrend.

We are currently Intermediate-term bearish and short-term bearish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist

Futures trading is speculative, leveraged, and involves substantial risks. Investing always involves risk, including the loss of principal, and futures trading could present additional risk based on underlying commodities investments.

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and changes of price movements.

The advance/decline line (A/D) is a technical indicator that plots the difference between the number of advancing and declining stocks on a daily basis. The indicator is cumulative, with a positive number being added to the prior number, or if the number is negative it is subtracted from the prior number.

The A/D line is used to show market sentiment, as it tells traders whether there are more stocks rising or falling. It is used to confirm price trends in major indexes, and can also warn of reversals when divergence occurs.

The percentage of stocks trading above a specific moving average is a breadth indicator that measures internal strength or weakness in the underlying index. The 50-day moving average is used for short-to-medium-term timeframes, while the 150-day and 200-day moving averages are used for medium-to-long-term timeframes. Signals can be derived from overbought/oversold levels, crosses above/below 50% and bullish/bearish divergences.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.