Virus Tales

When the medicine, shutting down our economy, is worse than the cure, alternatives surface.

When the medicine, shutting down our economy, is worse than the cure, alternatives surface.

For now, 1st quarter Gross Domestic Product, as reported by BEA, decreased at an annual rate of -4.8%. As I pen this, the Standards & Poors 500 index is up approximately 2.5% and up over 31% from its low on March 23rd. According to earnings data from S&P Dow Jones Indices, corporate earnings are estimated to be approximately 22% lower than in 2019. Is the worse over?

Some of the most recent research on how the disease spreads is revealing:

- Maria Van Kerkhove (WHO) contends after her study in Wuhan that the disease spread in close family and institutional proximity, not casual interaction

- Hendrik Streeck, the virologist researching Germany’s Heinsberg district, saw little evidence of contracting the disease through shopping or touching contaminated surfaces.

- China – in a study of 318 clusters, over a thousand patients, 80% were contaminated in the home versus only 34% in public transportation.

If we assume the worst-case scenario, as postulated by Avik Roy: Infection will not provide lasting immunity. Treatment for the infected will not materialize. Universal testing will not be readily available, and a vaccine will not develop. Then what?

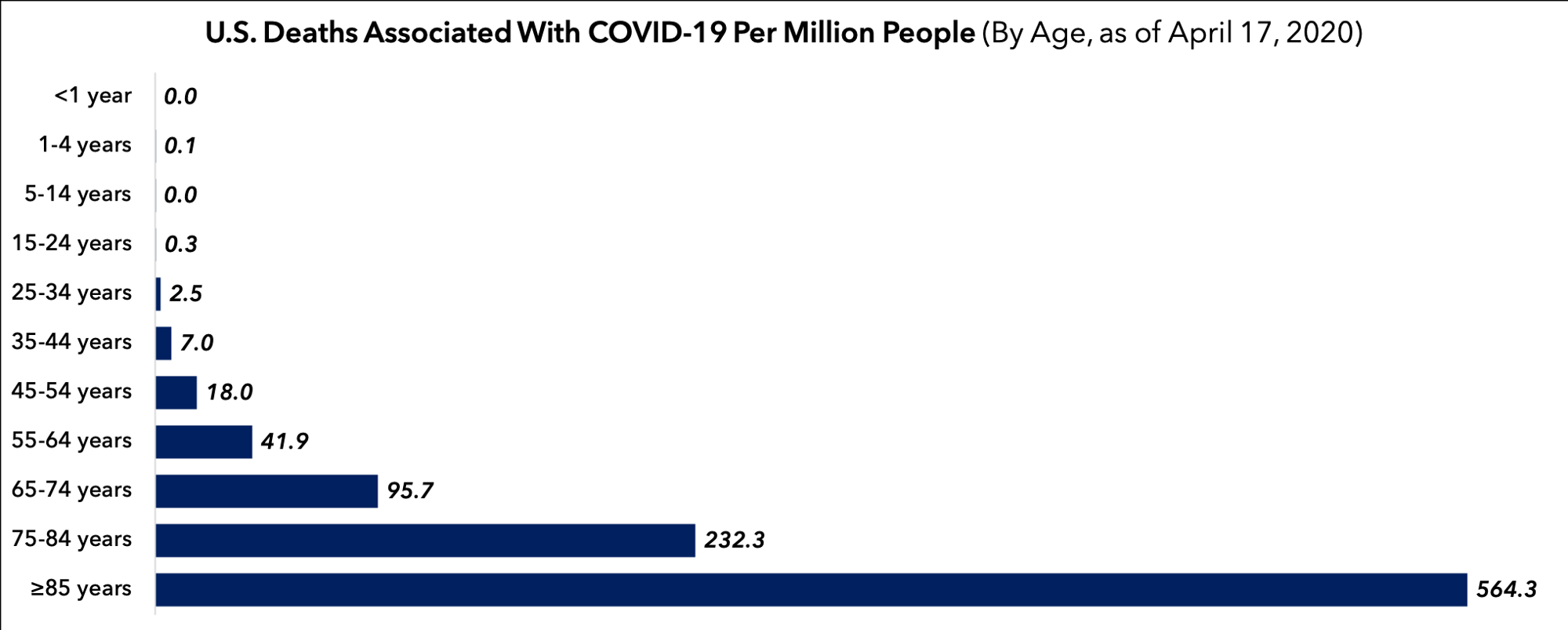

My advice; assimilate information about the spread of the disease and, together with the information on the risk of infection by age cohort, determine a plan for your family. For example, if like me, you are over 70 years of age and your grandchild goes back to school, which she should, based on her risk (0.0), you may want to put on hold, bringing her into your home. Or, if your immune system is suspect, you have an underlying adverse health condition, stay away until there is a treatment or a vaccine.

If we assume the best-case scenario, Dr. Stuart Schreiber, Ph.D.*, we have a vaccine developed in six months.

He is one of twelve scientists and billionaires who formed “Scientists to Stop Covid-19.” This group has a lot of influence across private enterprise and our government. This group has developed several innovative actions to combat the virus: This group has acted as go-between drug companies and the administration to weed-out flawed research before they reach policymakers. As an example, both the FDA and the Department of Veterans Affairs have implemented specific recommendations, including reducing manufacturing regulations for specific coronavirus drugs. Francis Collins, Health Director for The National Institutes of Health, agreed with most of the recommendations of the group’s 17-page confidential report passed along to Vice President Mike Spence and President Trump’s cabinet.

The Wall Street Journal likened this effort to The Manhattan Project.

Best case or worse case, we are going to get back to work. In my opinion, we are all going to get infected – have you ever met a person who avoided the flu?

Our citizens need to understand the risks they are taking by interacting and then acting accordingly. Our older population with underlying health conditions should desperately avoid exposure until a treatment or vaccine are available. The rest, get back to work, go back to school, get on with your life but be aware text grandma.

The current cure, isolation, is most likely worst than the disease; I believe we are discovering this. Progress is being made. I think the equity markets are looking forward and they like what they see: Me too.

Carlos Dominguez – CERTIFIED FINANCIAL PLANNER™, Portfolio Manager, RJFS

![]() When you get a minute try out our risk discovery tool – tell your friends

When you get a minute try out our risk discovery tool – tell your friends

https://windsorwealth.management/my-risk-o-meter/

* Dr. Stuart Schreiber, Ph.D. is a Professor of Chemistry and Chemical Biology at Harvard University and co-Founder of the Broad Institute. He is a member of the National Academy of Sciences, and a founder of Vertex Pharmaceuticals, Ariad Pharmaceuticals, Infinity Pharmaceuticals, Forma Therapeutics, H3 Biomedicine and Jnana Therapeutics. Schreiber co-pioneered the field of chemical biology.

Sources:

https://www.wsj.com/articles/the-media-vs-flatten-the-curve-11588113213?mod=opinion_featst_pos2

https://freopp.org/a-new-strategy-for-bringing-people-back-to-work-during-covid-19-a912247f1ab5?mod=article_inline&gi=c6c226fa89f6 https://www.bea.gov/news/2020/gross-domestic-product-1st-quarter-2020-advance-estimate

https://s.wsj.net/public/resources/documents/Scientists_to_Stop_COVID19_2020_04_23_FINAL.pdf

Sources are being provided for information purposes only. Raymond James is not affiliated with and does not, authorize, or sponsor any of the listed sources. Raymond James is not responsible for the content of any source or the collection or use of information regarding any source’s users and/or members. Past performance may not be indicative of future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is considered representative of the U.S. stock Market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Any opinions are those of Carlos Dominguez and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor recommendation. The information has been obtained from sources considered reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Dividends are not guaranteed and must be authorized by the company’s board of directors. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. Dollar cost averaging involves continuous investment regardless of fluctuating price levels of such securities but does not assure a profit and does not protect against loss. Investors should consider their financial ability to continue purchases through periods of low price levels. There is no assurance that any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss.