Morning Brief

Headline News:

The stock market is on course for a flattish start with futures on the S&P 500 trading seven points above fair value after a quiet night.

Equity futures have seen limited movement this morning, hanging onto their big gains from Tuesday. The overnight session did not cause any notable shifts in sentiment with the market remaining hopeful that the Israel-Iran ceasefire will hold.

President Trump is at the NATO summit in the Netherlands, where members are set to agree to an increase to the defense spending target to 5% of GDP.

Treasuries are little changed with the 10-yr yield up one basis point at 4.30% ahead of today’s $70 bln 5-yr note sale at 13:00 ET.

The market received the weekly MBA Mortgage Index this morning, which was up 1.1% to follow last week’s 2.6% decrease. Later in the day, the New Home Sales report for May (Briefing.com consensus 700,000; prior 743,000) will be released at 10:00 ET.

Fed Chairman Powell will continue his semiannual testimony on monetary policy to Congress, but today’s appearance before the Senate Banking Committee is not expected to produce many headlines.

(Michael Gibbs, Managing Director, Lead Portfolio Manager )

Markets:

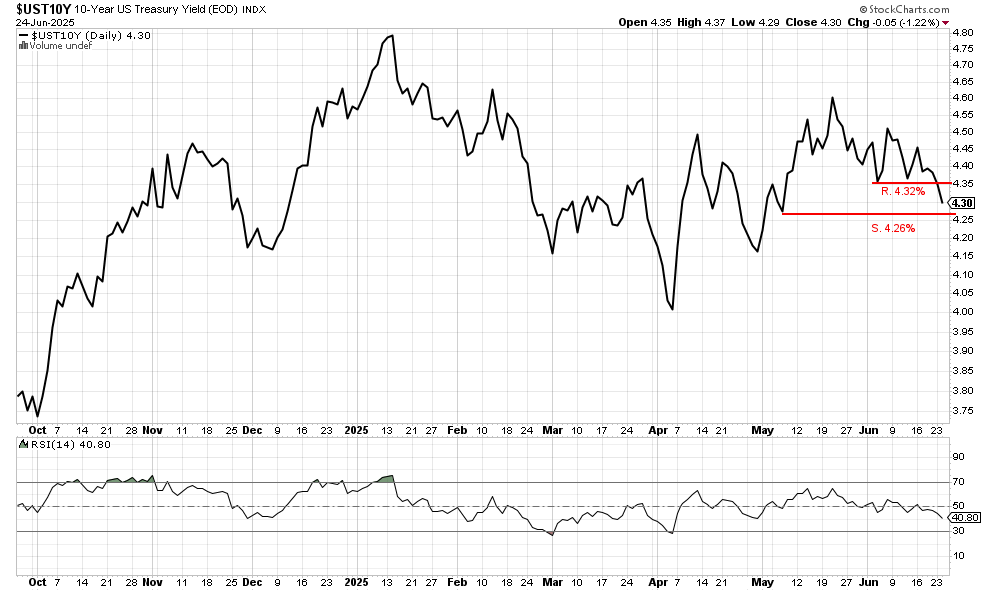

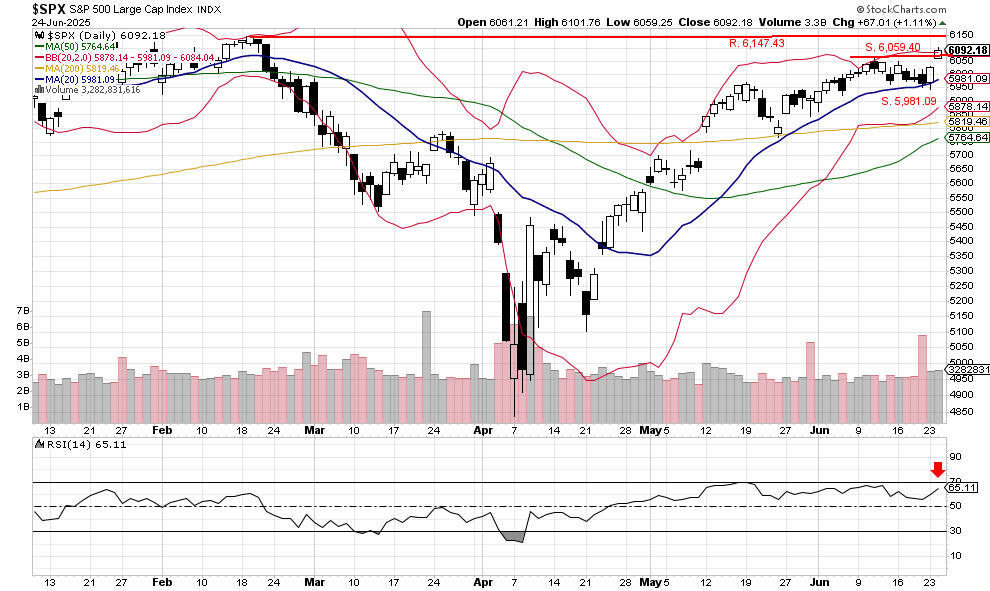

The S&P 500 rallied sharply, closing at 6,092.18 and breaking above the key resistance level of 6,059.04. Up volume accounted for 73% of total volume, indicating solid — but not yet decisive — buying interest. The index now sits at the upper Bollinger Band, while the RSI has yet to confirm the move by making a new high, suggesting the breakout is not fully confirmed. As a result, a retest of the new potential support at 6,059.40 is possible. A follow-through session with 80% or higher up volume would provide stronger confirmation of the breakout. Meanwhile, the 10-year Treasury yield has moved below 4.32%, with technical support near 4.26% likely to be tested in the coming days.

We are currently Intermediate-term bullish and short-term bullish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategists

Futures trading is speculative, leveraged, and involves substantial risks. Investing always involves risk, including the loss of principal, and futures trading could present additional risk based on underlying commodities investments.

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and changes of price movements.

The percentage of stocks trading above a specific moving average is a breadth indicator that measures internal strength or weakness in the underlying index. The 50-day moving averages are used for short-to-medium-term timeframes, while the 150-day and 200-day moving averages are used for medium-to-long-term ones. Signals can be derived from overbought/oversold levels, crosses above/below 50%, and bullish/bearish divergences.

The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author, John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed due to the federal government’s timely principal and interest payment. Bond prices and yields are subject to change based on market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall, and when interest rates fall, bond prices generally rise.

The Nasdaq 100 (^NDX) is a stock market index made up of 103 equity securities issued by 100 of the largest non-financial companies listed on the NASDAQ. It is a modified capitalization-weighted index. It is based on exchange and not an index of U.S.-based companies.

The Russell 2000 Index is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. It is managed by London’s FTSE Russell Group and is widely regarded as a bellwether of the U.S. economy because it focuses on smaller companies that focus on the U.S. market.