Morning Brief

Headline News:

The S&P 500 futures are down 5 points and are trading 0.2% below fair value. The Nasdaq 100 futures are up 34 points and are trading 0.3% above fair value. The Dow Jones Industrial Average futures are down 90 points and are trading 0.3% below fair value.

The equity futures market is mixed this morning as investors weigh ongoing concerns about the banking sector after Bloomberg reported that First Republic Bank (FRC) is considering a sale and Fitch placed Western Alliance Bancorporation (WAL) on rating watch negative. The Nasdaq 100 futures have been outperforming due to some favoritism for high-quality growth names, helped along by pleasing earnings and guidance from Adobe (ADBE).

Participants are nervously anticipating the European Central Bank (ECB) policy rate decision at 9:15 a.m. ET. Reports suggest the ECB is still leaning toward a 50-basis points rate hike.

The 2-yr Treasury note yield is down two basis points to 3.94%, and the 10-yr note yield is down three basis points to 3.46%.

(Michael Gibbs, Director of Equity Portfolio & Technical Strategy)

Markets:

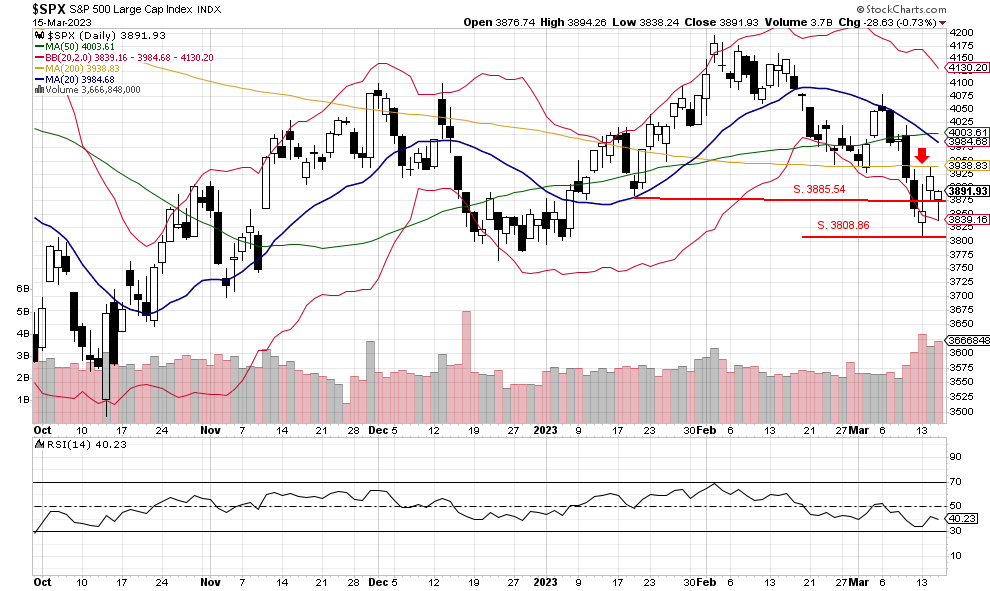

The S&P 500 traded in a wide range with massive volume of 3,666,848,000 and managed to close higher at 3891.93. The index remained above support at 3885.54 and has moved away from the lower Bollinger Band. The internal indicators remain oversold, and there is the potential for more buying possibly come in today. If so, potential resistance is now at the 200-day moving average of 3933.83, but we feel that level will not be tested today.

We are currently Intermediate-term bearish and short-term bearish.