“My retirement account is going down faster than my deposits, for Pete’s sake!”

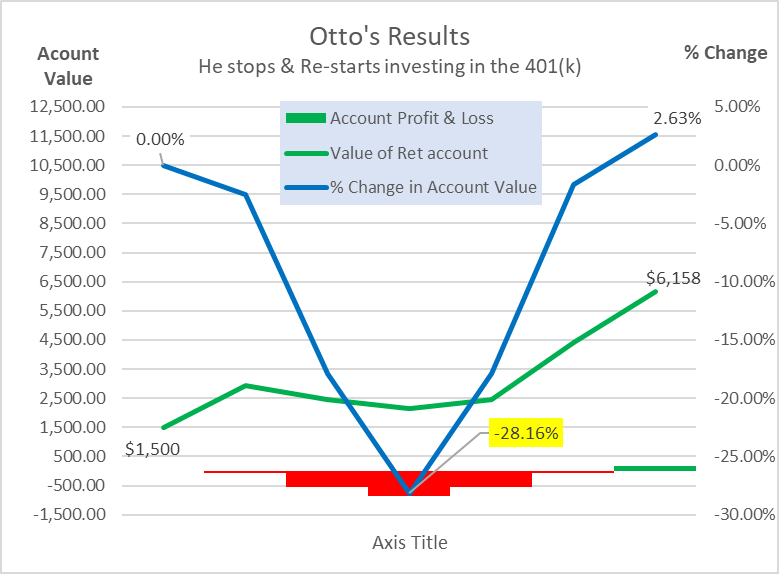

And “I stopped making contributions to my retirement account until the “Stock Market” recovers.”- Otto said. Cecilia, on the other hand, is oblivious to the value of her retirement account, and her contributions continue. So, what are the outcomes?

The following hypothetical example tests the question.*

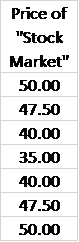

Let’s say Otto stops making retirement plan  contributions when the “Stock Market” drops from $50.00 to $47.50; then, resumes making contributions when prices climb back where he left off, at $47.50. This action would have skipped the drop to $35.00.

contributions when the “Stock Market” drops from $50.00 to $47.50; then, resumes making contributions when prices climb back where he left off, at $47.50. This action would have skipped the drop to $35.00.

Yet, his account value dropped by about -28%.

As the “Stock Market” recovers back to $50.00, the price at which he started making deposits, his account balance reaches $6,158 for a compounded rate of return of 2.63%.

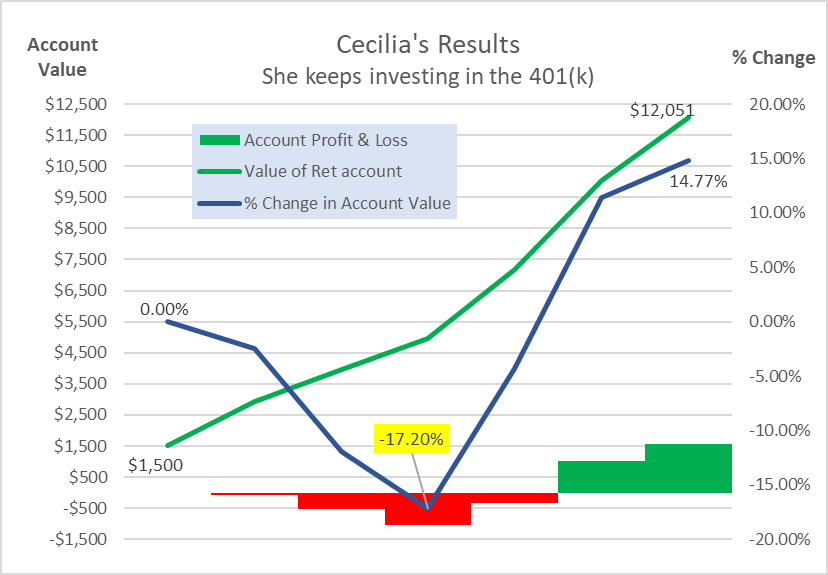

By neglecting to look at her account, Cecilia lets her deposits continue, and allows the investments to ride. As a result, her maximum draw down is only -17% to Otto’s -28%. And, her compounded rate of return is 14.77% versus Otto’s 2.6%.

How are these seemingly counter-intuitive outcomes possible?

Simple: by continuing to purchase as prices decline, Cecilia accumulates 241 shares at an average price of $43.50 to Otto’s average share price of $49, resulting in 123 shares accumulated, half as many shares, as Cecilia’s 241 shares. As the “Stock Market” recovers from its dip, Cecilia’s portfolio grows much faster. Why? She purchased more shares at lower prices – bought low and bought twice as many thus recovering, on average twice as quickly with twice as much: $12,051 versus $6,158 for Otto.

Buy low and hold, sell later….

Carlos Dominguez, CFP® – Portfolio Manager

*Hopefully the reader will understand that the hypothetical and example discussed in this brief article is not intended to represent reality in any form but simply puts forth the idea that “Stock Markets” fluctuate and that by consistently having the faith to invest, mainly when equities retreat, usually results in a reasonably good wealth accumulation strategy. The hypothetical does not reflect actual investment results and is not a guarantee of future results. Results may vary for each investor and over time.

Sources are being provided for information purposes only. Raymond James is not affiliated with and does not, authorize, or sponsor any of the listed sources. Raymond James is not responsible for the content of any source or the collection or use of information regarding any source’s users and/or members. Past performance may not be indicative of future results. The S&P 500 is an unmanaged index of 500 widely held stocks that is considered representative of the U.S. stock Market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Any opinions are those of Carlos Dominguez and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor recommendation. The information has been obtained from sources considered reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Dividends are not guaranteed and must be authorized by the company’s board of directors. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. Dollar cost averaging involves continuous investment regardless of fluctuating price levels of such securities but does not assure a profit and does not protect against loss. Investors should consider their financial ability to continue purchases through periods of low price levels. There is no assurance that any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss.