Morning Brief

Headline News:

The S&P 500 futures are down 28 points and are trading 0.5% below fair value, the NASDAQ 100 futures are down 58 points and are trading 0.3% below fair value, and the Dow Jones Industrial Average futures are down 291 points and are trading 0.7% below fair value.

Early trading has a negative bias driven by ongoing consolidation efforts. The political uncertainty surrounding the French election, which sent European indices lower today, has contributed to the downside bias this morning.

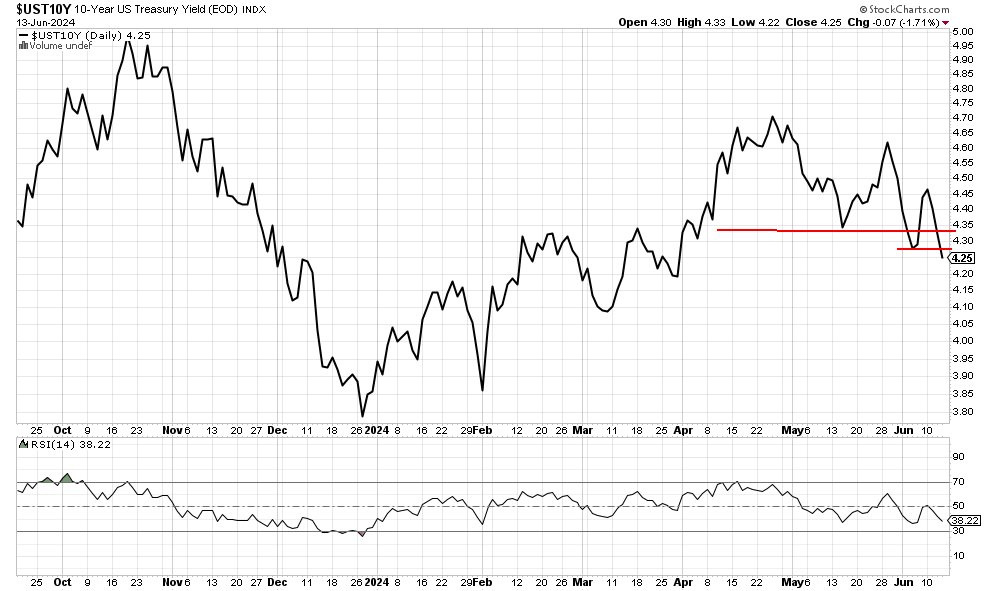

Treasury yields are slightly lower in a flight-to-safety bid related to political uncertainty. The 10-year note yield is down four basis points to 4.20%, and the 2-year note yield is down one basis point to 4.68%.

(Michael Gibbs, Managing Director, Lead Portfolio Manager)

Markets:

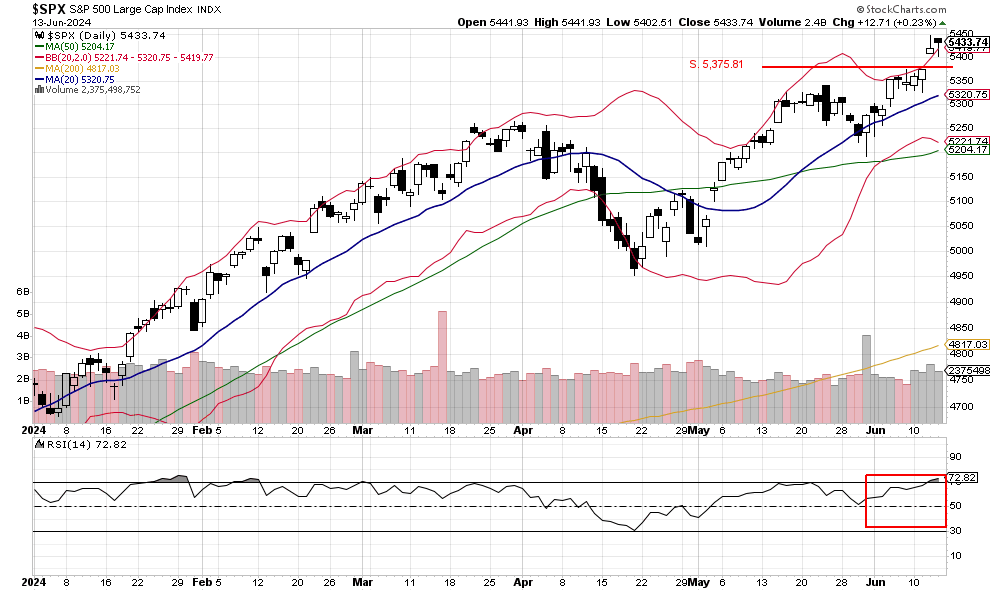

The S&P 500 closed at another new all-time high at 5,433.74 and also outside the upper Bollinger Band. The RSI index also closed in the overbought zone, so we feel the S&P 500 could see a pullback soon. If so, the potential resistance at 5,375.81 should hold if tested today. However, the selling could end quickly after the 10-year treasury moved through another support level and closed at a yield of 4.25%.

We are currently Intermediate-term bullish and short-term bearish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist