Morning Brief

Headline News:

The S&P 500 futures are down 13 points and are trading 0.3% below fair value, the NASDAQ 100 futures are down 56 points and are trading 0.3% below fair value, and the Dow Jones Industrial Average futures are down 61 points and are trading 0.2% below fair value.

This holiday-shortened week is setting up to start on a lower note due in part to pre-open losses in some influential stocks. Rising market rates have also contributed to the negative bias this morning. The 10-year note yield is back above 4.00%, up six basis points from Friday at 4.01%. The 2-yr note yield is up six basis points from Friday at 4.21%.

Geopolitical worries are still in play this week after a Houthi missile struck a U.S. commercial ship, according to The New York Times. Also, China is expected to increase coercive measures towards Taiwan, according to Axios, after Lai Ching-te won Taiwan’s presidential election.

On a China-related note, the People’s Bank of China left its medium-term policy rate unchanged, but there was speculation about more stimulus in the near future.

(Michael Gibbs, Managing Director, Lead Portfolio Manager)

Markets:

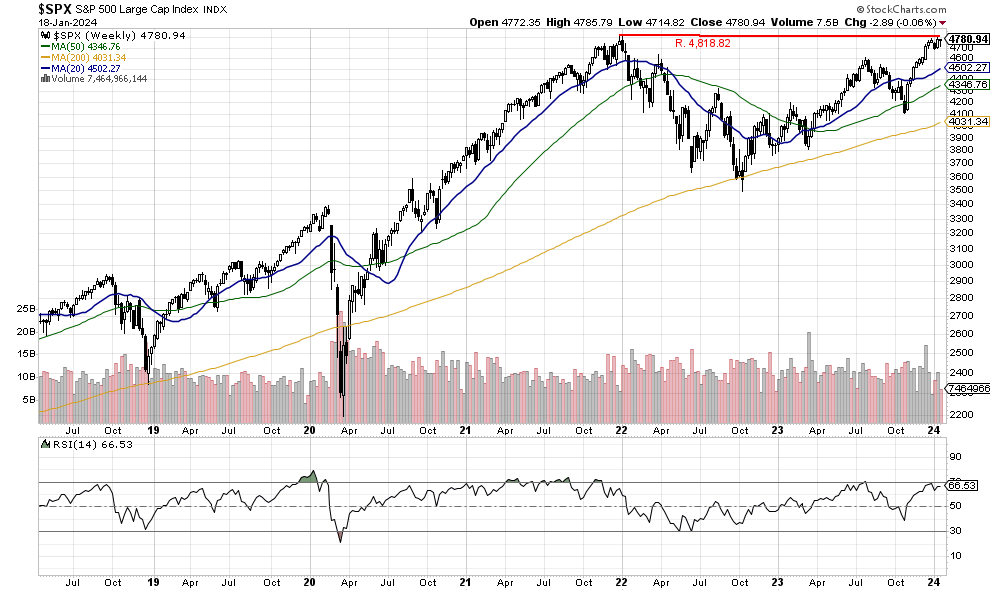

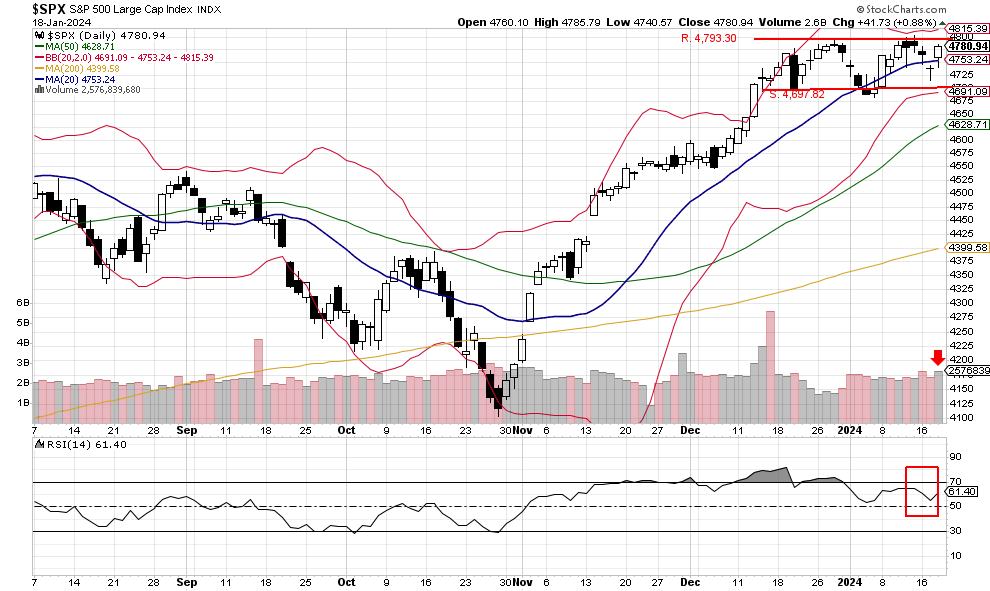

The S&P 500 did rally to close above the 20-day moving average, with higher volume than the previous day. Also, the RSI index closed higher in support of the rally, with the S&P 500 at 4,780.94 to start the day. The only negative was the up volume came in at only 48% of the overall volume. However, we feel the S&P 500 can test the potential resistance level at 4,793.30 today and possibly even close above that level and set up an attempt at the all-time high at 4,818.82 soon.

We are currently Intermediate-term bullish and short-term bullish.