Morning Brief

Headline News:

The S&P 500 futures are down 27 points and are trading 0.7% below fair value. The Nasdaq 100 futures are down 135 points and are trading 1.1% below fair value. The Dow Jones Industrial Average futures are down 162 points and are trading 0.4% below fair value.

Equity futures indicate a lower open following yesterday’s reversal that took the S&P 500 below 4,100. Investors are still trading cautiously.

Oil prices rose sharply overnight ($79.71/bbl, +1.65, +2.1%) following reports that Russia is aiming to lower its March oil output by 500,000 barrels, according to Bloomberg, in response to sanctions.

Treasury yields remain elevated, keeping pressure on the equity market. The 2-yr note yield sits at 4.51%, and the 10-yr note yield is at 3.70%. The U.S. Dollar Index is up 0.3% to 103.48.

Market participants will receive the following economic data today:

- 10:00 ET: February Preliminary the University of Michigan Consumer Sentiment (Briefing.com consensus 65.0; prior 64.9)

- 14:00 ET: January Treasury Budget (prior -$85.0B)

(Michael Gibbs, Director of Equity Portfolio & Technical Strategy)

Markets:

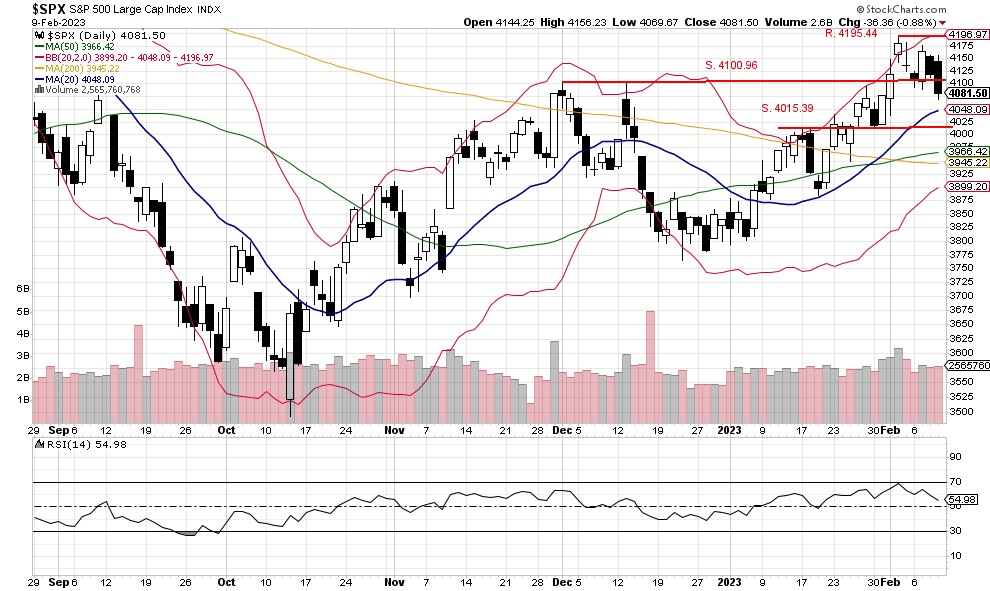

The S&P 500 sold off below support at 4100.96 to close at 4081.50. The volume came in at 2,565,760,768, with down volume of 75%, showing the selling was only moderate. Today, the index should test the 20-day moving average at 4048.09 and hold. If not, the next potential support is at 4015.39; below that is the 50-day moving average at 3966.42. The selling should stop at one of those levels as the internals would be close to oversold, hopefully bringing buyers back into the market.

We are currently Intermediate-term bearish and short-term bullish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist