Morning Brief

Headline News:

Wall Street is set for a slightly higher open after Fed Chairman Jerome Powell reiterated that the central bank would not quickly raise interest rates. He also stated that he encouraged a “broad and inclusive” recovery for the job market. Later today, the IHS Markit Manufacturing and Services PMI for June and New Home Sales for May will be released. The data could give investors guidance on the health and growth rate of the U.S. economy.

Markets:

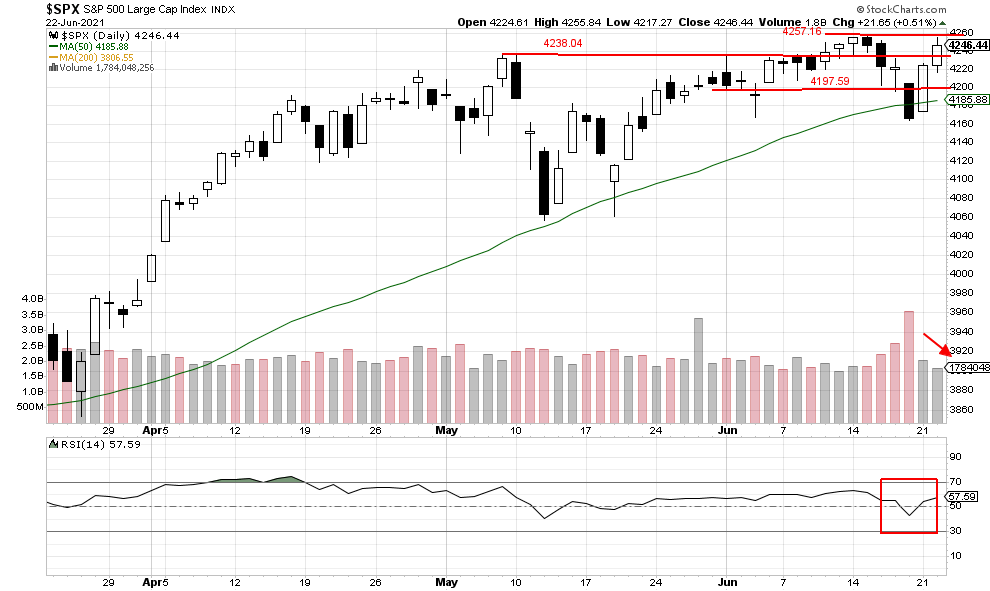

The S&P 500 rallied again on Tuesday and briefly tested the all-time high before closing at 4246.44. However, the rally did come with lower volume again, with only 1,784,048,256 shares traded. In addition, the index has moved off the 6/18/2021 low in a v shape pattern which is typically short-lived. So, a new base at these levels will once again have the index in position to achieve a potential new high. We also expect selling at the next resistance level at 4257.16 to be strong and possibly hold today.

We are currently long-term bullish and short-term bearish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist

Futures trading is speculative, leveraged, and involves substantial risks. Investing always involves risk, including the loss of principal, and futures trading could present additional risk based on underlying commodities investments.

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and changes of price movements.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.

New home sales measure the number of newly constructed homes with a committed sale during the month. The level of new home sales indicates housing market trends and, in turn, economic momentum and consumer purchases of furniture and appliances.

The flash Composite Purchasing Managers’ Index (PMI) provides an early estimate of current private sector output by combining information obtained from surveys of around 1,000 manufacturing and service sector companies. The flash data are released around 10 days ahead of the final report and are typically based upon around 85 percent of the full survey sample. The report tracks changes in variables such as new orders, stock levels, employment and prices across both manufacturing and services. Production is also tracked, defined as “production” for manufacturing and “output” for services. Results are synthesized into a single index which can range between zero and 100. A reading above (below) 50 signals rising (falling) output versus the previous month and the closer to 100 (zero) the faster output is growing (contracting). The report also contains flash estimates of the manufacturing and services PMIs. The data are produced by IHS Markit.