Morning Brief

.Headline News:

The S&P 500 futures are up four points and are trading 0.2% above fair value. The Nasdaq 100 futures are up 19 points and are trading 0.1% above fair value. The Dow Jones Industrial Average futures are down 20 points but are trading 0.1% above fair value.

It has been a very good week thus far for the major indices, which have shown a propensity to emphasize positive news over bad news (or to find the good in the bad). The scope of losses coming into this week (S&P 500 and Nasdaq down seven straight weeks and DJIA down eight straight weeks) has created a setup for that mentality and has fostered bargain-hunting interest in many beaten-down stocks.

The market’s resilient disposition is on display again this morning, as market participants are seemingly looking through disappointing earnings and guidance from Gap (GPS) and American Eagle Outfitters (AEO), and indications of margin pressures at Costco (COST), to upbeat results and guidance from the likes of Dell (DELL) and Ulta Beauty (ULTA) as grounding points.

Soon, they will be looking at the April Personal Income and Spending Report. It is out at 8:30 a.m. ET and it will include the Fed’s preferred inflation gauge in the form of the core-PCE Price Index. Market participants are hoping to see some welcome moderation in the year-over-year rate of core-PCE to feed the peak inflation narrative.

The 10-yr note yield is down three basis points to 2.73% in front of the report. The U.S. Dollar Index is little changed at 101.78. WTI crude futures are down 0.7% to $113.44/bbl.

(Michael Gibbs, Director of Equity Portfolio & Technical Strategy)

Markets:

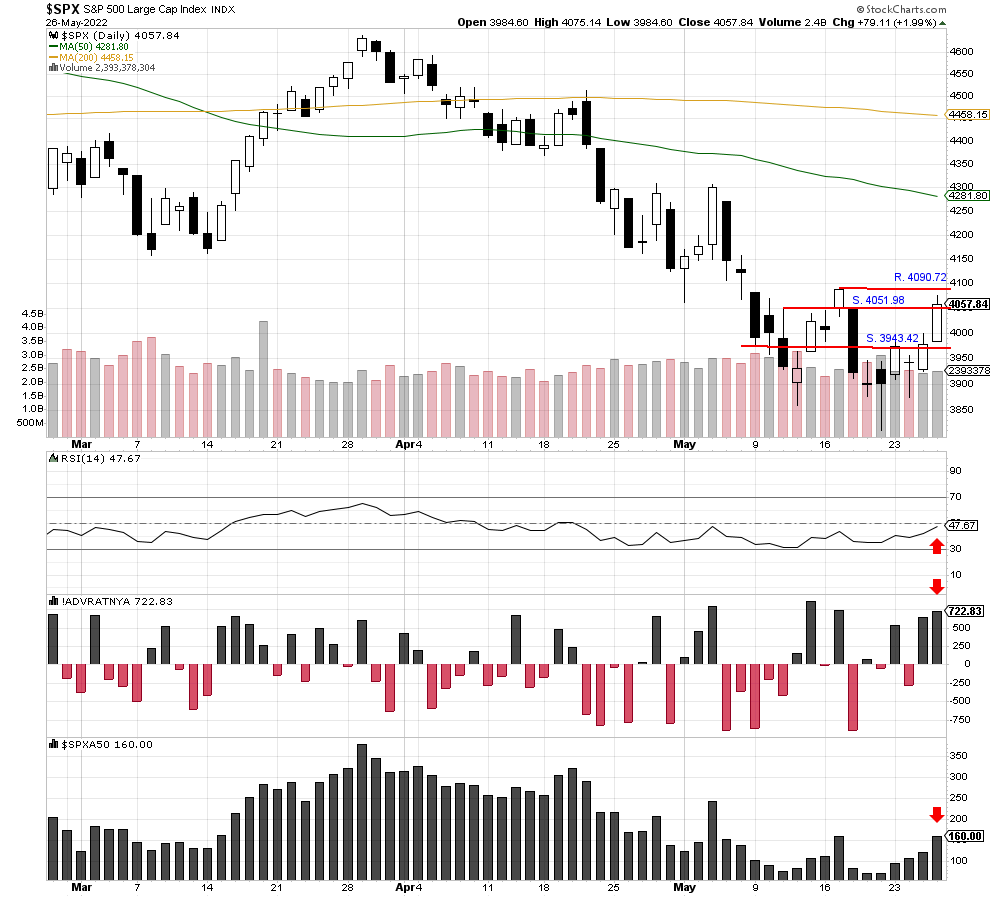

The S&P 500 rallied for the second day, moving past resistance and closing much higher at 4057.84. We feel the index rallied in anticipation of a lower PCE inflation report and that report was indeed reported lower this morning. The RSI index, advance/decline indicator, and net new high index also moved higher in support of the rally. A move above potential resistance at 4090.72 would be bullish today. However, the index may trade flat due to the three-day holiday weekend.

We are currently Intermediate-term bearish and short-term bearish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist