Morning Brief

Headline News:

Wall Street is set to open higher after investors appeared to ignore a report showing a rise in inflation. Consumer prices as measured by the personal consumption expenditures rose 0.7% in April and 3.1% for 12 months through April. Personal income also increased by 20.9% in March following the latest round of stimulus checks but was lower by 13.1% year over year. Also, the savings rate remained higher at 14.9%, and disposable personal income, after taxes and other withholdings, fell by 14.6%.

Markets:

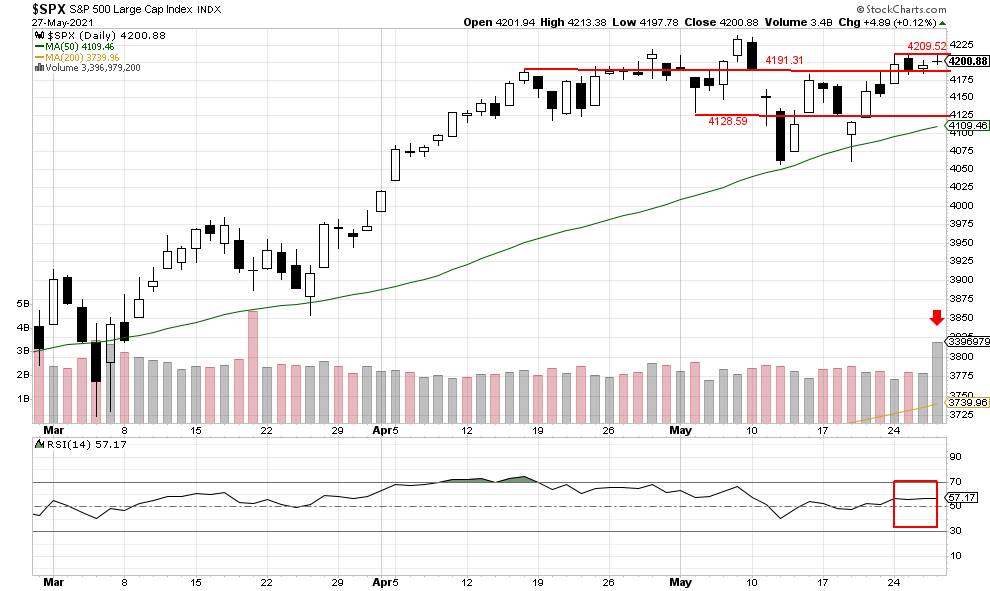

The S&P 500 had a massive volume trading day as investors positioned themselves before releasing a significant inflation gauge. Volume came in at a staggering 3,396,979,200, but the index could only close flat at 4209.52. The heavy volume also shows the bulls and bears a still very active. RSI also traded flat, closing at 57.17. The index has formed the base we have been looking for and is set to potentially breakout and test the all-time high. We are moving our stance back to short-term bullish. Potential resistance could now come in at 4209.52, and possible support is at 4191.31.

We are currently long-term bullish and short-term bullish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist

Futures trading is speculative, leveraged, and involves substantial risks. Investing always involves risk, including the loss of principal, and futures trading could present additional risk based on underlying commodities investments.

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and changes of price movements.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.

Personal income represents the income that households receive from all sources including wages and salaries, fringe benefits such as employer contributions to private pension plans, proprietors’ income, income from rent, dividends and interest and transfer payments such as Social Security and unemployment compensation. Personal contributions for social insurance are subtracted from personal income.

Personal consumption expenditures are the major portion of personal outlays, which also include personal interest payments and transfer payments. Personal consumption expenditures are divided into durable goods, nondurable goods and services. These figures are the monthly analogues to the quarterly consumption expenditures in the GDP report, available in nominal and real (inflation-adjusted) dollars. Economic performance is more appropriately measured after the effects of inflation are removed.

Each month, the Bureau of Economic Analysis also compiles the personal consumption expenditure price index, also known as the PCE price index. This inflation index measures a basket of goods and services that is updated annually in contrast to the CPI, which measures a fixed basket.

The term personal consumption expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time. Personal income, PCEs, and the PCE Price Index reading are released monthly in the Bureau of Economic Analysis (BEA) Personal Income and Outlays report. Personal consumption expenditures support the reporting of the PCE Price Index, which measures price changes in consumer goods and services exchanged in the U.S. economy.