Morning Brief

Headline News:

U.S. stock futures are higher in early trading despite the first reported case of Omicron in the United States. Entertainment and leisure stocks were higher in the pre-market, with Boeing (BA), Royal Caribbean (RCL), and MGM Resorts (MGM) all higher by 2%. Meanwhile, Fed Chari Jerome Powell told Congress on Wednesday that the “economy is very strong and inflation pressure are higher. It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we announced at the November meeting, perhaps a few months sooner.”

Markets:

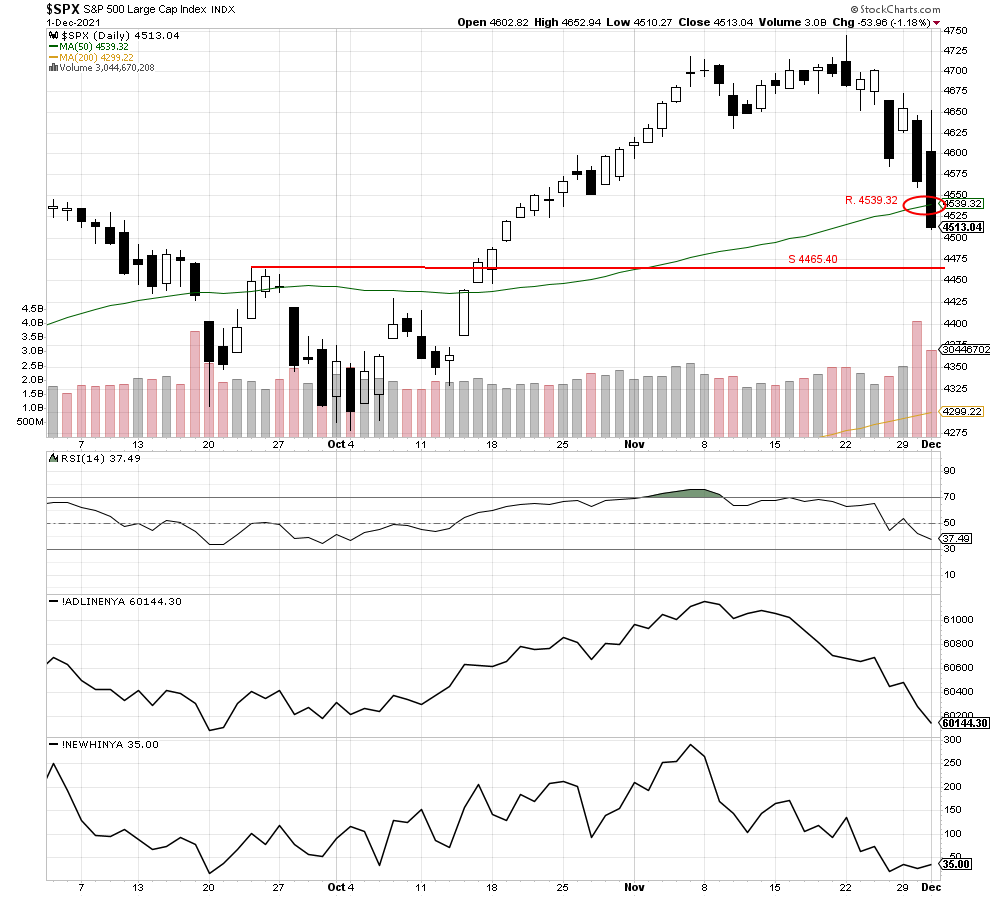

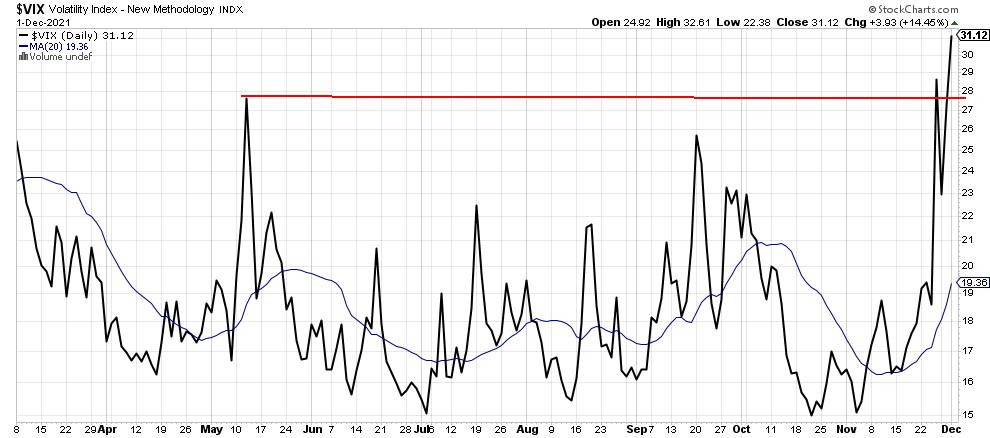

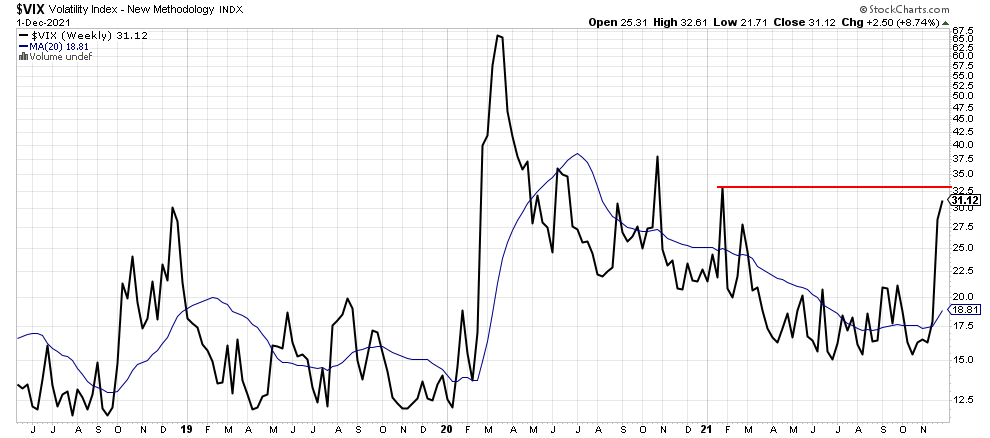

The S&P 500 moved below the 50-day moving average and closed lower at 4513.04 with volume of 3,044,670,208. The vast two-day increase in volume shows investors are now very concerned and want to hold safer investments. Also, the volatility index moved higher and is now near the 1/25/21 high of 37.51. The move below the 50-day average was surprising and has driven us to a short-term bearish stance for now. The next potential support level could not come in at 4465.40.

We are currently Intermediate-term bullish and short-term bearish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJFS

Partner, DJWMG

Windsor Wealth Planners & Strategist

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.

The Cboe Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants