Daily Commentary

Headline News:

U.S. stock futures are trading at new all-time highs to start the week on hopes of a new relief package, and a speedy vaccine rollout that will prop up the U.S. economy. Treasury Secretary Yellen said if Congress approves the $1.9 trillion plan, the county could be at full employment in 2022. The CDC also announced that 31.59 million people had received one or more doses of the COVID-19 vaccines, while 9.1 million people go the second shot as of Sunday.

Markets:

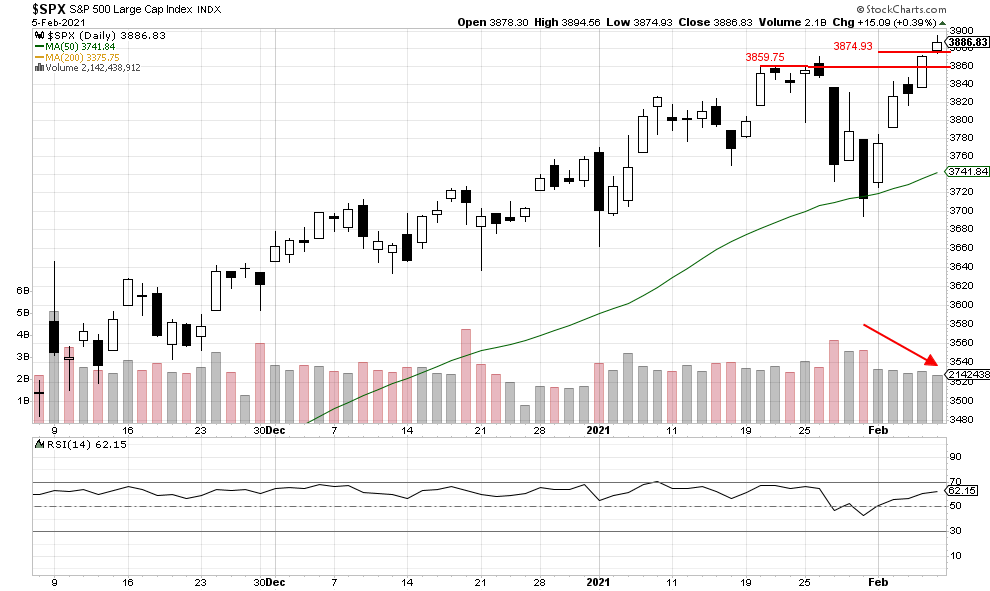

The S&P 500 closed at another all-time high at 3886.83 on Friday, capping off a massive rally for the week. However, volume continues only be average, which is a concern. The index is not yet overbought, so there is room to potentially move higher this week. Potential support could come in at 3874.93 and then at 3859.75. Possible resistance will be the all-time high at 3894.56. We feel some sideways trading would be healthy but the recent uptrend should be in place as a new trading week starts.

We are currently long-term bullish and short-term bullish.

John N. Lilly III CPFA

Accredited Portfolio Management Advisor℠

Accredited Asset Management Specialist℠

Portfolio Manager, RJ

Partner, DJWMG

Windsor Wealth Planners & Strategist

Futures trading is speculative, leveraged, and involves substantial risks. Investing always involves risk, including the loss of principal, and futures trading could present additional risk based on underlying commodities investments.

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and changes of price movements.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. Past performance may not be indicative of future results. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investors’ results will vary. Opinions expressed are those of the author John N. Lilly III, and not necessarily those of Raymond James. “There is no guarantee that these statements, opinions, or forecast provided herein will prove to be correct. “The information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk, and you may incur a profit or loss. No investment strategy can guarantee success. The charts and/or tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets.

This is not a recommendation to buy or sell any company’s stock mentioned above.