Morning Brief

Headline News:

The S&P 500 futures are down 6 points and are trading 0.1% below fair value. The NASDAQ 100 futures are down 90 points and are trading 0.5% below fair value. The Dow Jones Industrial Average futures are up 35 points and are trading 0.1% above fair value.

Stock futures are mixed as market participants digest a slate of mixed earnings news and continue to contend with concerns about the market being overbought and due for a pullback.

Following their massive gains to start the year, a few of the large names in Tech and Comm. Services are showing sizable declines after their second-quarter earnings reports, which is weighing on the broader market. The Dow Jones Industrial Average futures, meanwhile, outperform thanks to gains in insurers and health care names.

In central bank news, the People’s Bank of China made no changes to its one-year and five-year loan prime rates.

Treasury yields are moving higher. The 2-yr note yield is up five basis points to 4.81%, and the 10-yr note yield is up four basis points to 3.78%.

(Michael Gibbs, Managing Director, Lead Portfolio Manager)

Markets:

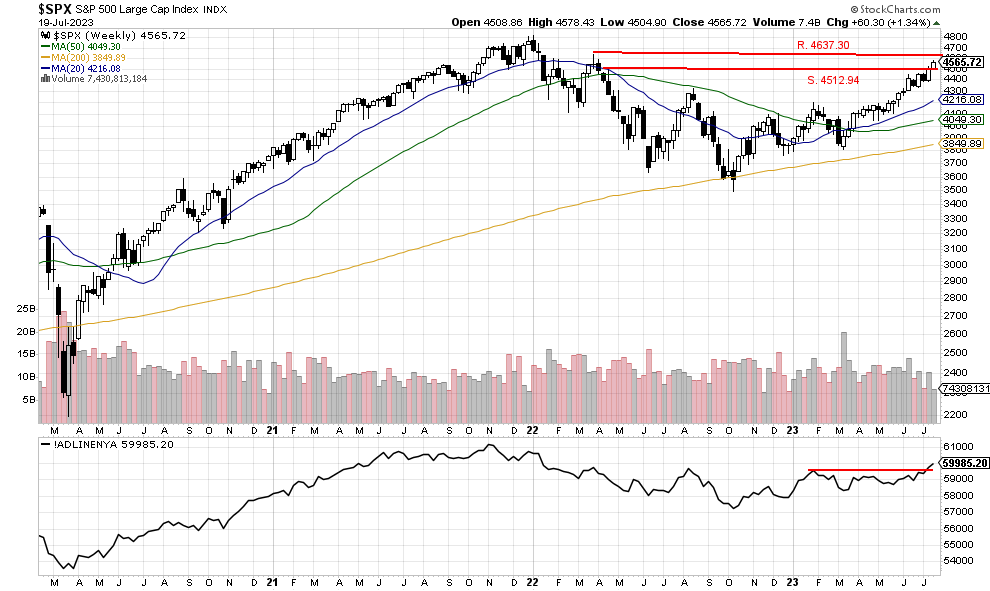

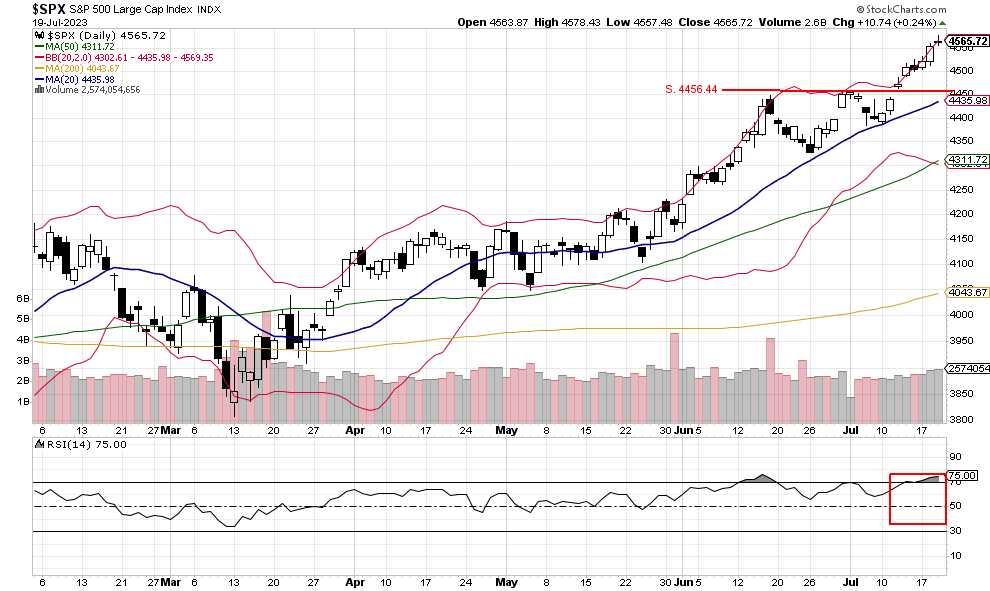

The S&P 500 closed at another high for the year at 4565.72, and the RSI index also closed higher at 75 while moving further into the overbought zone. We continue to believe the S&P 500 needs to pull back soon before the uptrend can continue. The index has closed at the upper Bollinger Band for the last five trading days, which is a critical overbought signal.

So far this morning, Netflix (NFLX) and Tesla (TSLS) are lower after earnings reports, so the sellers could potentially come in today when markets open..

We are currently Intermediate-term bearish and short-term bullish.