Elections and Stocks: Wishes & Myths

Well, somebody did it….

We cannot get away from it. The political noise has started, and it is intensifying. Our friends and advocates are asking: What does it mean for my portfolio?

“The world, oops, the Bull-Market, as we know it, is going to come to an end if ******* gets elected.” So goes the recent spectacle of opinions.

Some of the uncertainties surrounding this election cycle will most likely spill over into stock prices, up or down, the effect most likely will be temporary and short-lived; no one knows or can predict the impact or direction, in my opinion.

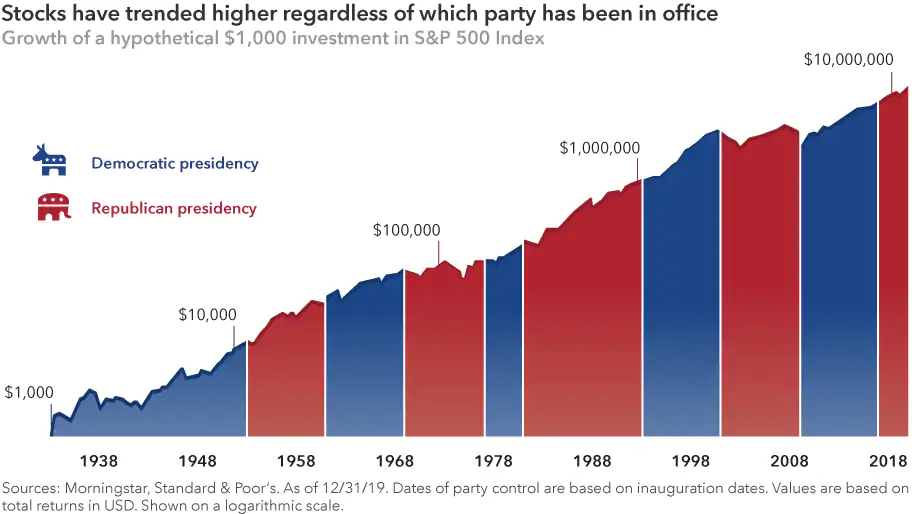

Myth – Election results make a difference in portfolio returns.

Fact – When investing in equities, the probability of having a positive return in the first twelve months after the initial investment occurs approximately 73% – 74% of the time: Which syncs, admirably, with Schwab’s research finding that equity markets ended in positive territory in 17 out of 23 presidential elections = 74% of the time.

Democrats vs. Republicans – Myth: “Stocks always do better when Republicans win.”

Fact – According to Fidelity: If Republicans sweep the white house and congress, during the first two years of the presidency, stock returns are just over 12% compared to about 3% for a Democratic sweep. However, after four years, there’s almost no difference, +8.6% vs. +8.2%.

The same is true for a Presidential election: During the first two years after a Republican President wins, stocks go up by about 8% vs. approximately 6% for Democrats. But, after four years, the difference narrows to +8.6% vs. +8.8% = no practical difference.

So, vote for your favorite, knowing that your wish will most likely come true.

Carlos Dominguez – CERTIFIED FINANCIAL PLANNER™, Portfolio Manager, RJFS

![]() When you get a minute try out our risk discovery tool – tell your friends

When you get a minute try out our risk discovery tool – tell your friends

https://windsorwealth.management/my-risk-o-meter/

Sources:

Photo by Derick McKinney, cropped by me.