Investment Philosophy Statement & Business Operating Model for Discretionary Portfolios

Objective:

The objective of our strategies is to help provide our clients with potential returns consistent with the client’s wealth planning goals and objectives and help minimize risk exposure.

Philosophy:

Our investment philosophy consists of a bottom-up approach which focuses on the analysis of individual securities for which we employ active managers and a top-down approach which focuses on the “big picture”, macro analysis, which we determine with the counsel of both external and internal knowledge sources.

Method:

During economic contractions, we aim to utilize defensive positioning in order to help minimize portfolio draw-downs; this may range from overweighting cash and fixed income to using securities with inverse exposure to broad market averages. During market expansions our portfolio strategies are generally positioned to take advantage of at-risk assets by utilizing a bullish portfolio posture; this could consist of underweighting cash and fixed income and favoring equities both domestic and foreign. In almost all market environments our strategies hold Investment Alternatives; these consist mostly of commodities, hedge fund indexes, managed futures and long/short funds. Our purpose is to search for investments with the potential to reduce portfolio risk and for those designed to exhibit a lack of correlation to most other securities.

Cyclical Asset Allocation:

Our investment strategies are based on a modification of Strategic Asset Allocation portfolios. We employ a Cyclical Asset Allocation method which we believe captures the benefits of using both a top-down and bottoms-up investment approach.

By way of explanation, asset allocation is the combination of equities, fixed income, other securities and cash in the portfolio. Its purpose is to match a client’s return objective, risk tolerance and time horizon by allocating funds between different asset classes in an attempt to provide the desired return while minimizing risk. However, we believe asset allocation by itself does not assure a profit or protect against loss in declining markets.

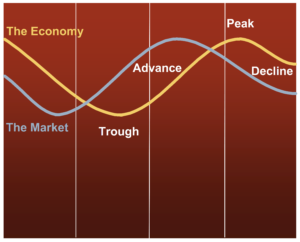

Asset allocation based on cyclical considerations is designed to anticipate the movement of asset classes based on each economic cycle’s unique characteristics. The markets (stocks, commodities, real estate, bonds) and asset classes (large, mid and small cap stocks, value and growth stocks, high and low quality bonds, domestic and foreign securities) each perform in their own unique way at each phase of the economic cycle.

Cyclical Asset Allocation takes a three to five year forward view taking into consideration the current economic cycle, the anticipated movement of that cycle and asset class valuations. It places its emphasis on future expectations.

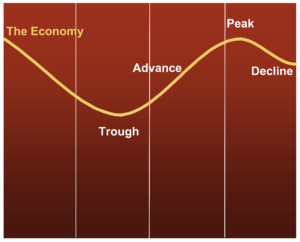

Generally the economic cycle progresses through four phases: recession, trough, recovery and expansion.

Historically certain asset classes and investment management styles tend to outperform others during specific phases of the economic cycle. Forecasting asset class return performance is based on historical ranges relative to the economic cycle and relative asset class valuations. The process embodies both quantitative and qualitative analysis and takes into account several factors used to determine the risk and reward trade-offs; the following is not all inclusive:

- General economic conditions

- The legislative environment

- The global environment

- Currency and commodity valuations

- The interest rate environment

- The future value of earnings

- Valuations across all asset classes and investment styles

We believe that it is important to note that asset class and investment style forecasting is aggregated for the purposes of publishing the quarterly Cyclical Allocation publication which expresses the recommended allocation by asset allocation objective and portfolio, i.e., Growth versus Growth & Income, for example. Also important, we believe, is the emphasis on the risk assessment of different asset classes relative to each other and the environments in which they exist at a point in time during a particular phase of the economic cycle.

Raymond James and firm correspondent research providers encompass each major asset class: equities, fixed income, and alternatives (including futures and commodities). Quarterly publications and research recommendations from these groups are available on a more formal basis.

Windsor Wealth Investment Portfolio Strategies:

We employ several customized Cyclical Portfolio Strategies ranging from Long Term Growth to Moderate Growth & Income. We aim to employ primarily mutual funds and exchange traded funds for our portfolio strategies.

Exchange Traded Funds are used to allocate the tactical allocation element of the portfolio strategy. Mutual Funds are used as our core holdings. On some occasions, for appropriate accredited investors we may use private money managers inclusive of an alternative investments category to include investment vehicles such as but not limited to: Hedge Funds, Private Equity in both the primary and secondary markets, Private Equity Real Estate, and Managed Futures.

Risk Management:

A key element of our risk management is our goal to methodically minimize the risk exposure of our portfolio strategies by increasing the cash position and allocation to alternative investments. We employ both qualitative and quantitative factors to managing risk. It should be noted that the tactical element of the portfolio strategy may take inversely correlated positions on any asset class; most commonly, stocks, bonds as well as asset classes such as commodities, hedge funds, and currencies. We employ several factors in determining whether our portfolio strategies should be positioned defensively or not, the following summary describes the basics:

- Our economic indicators are based on economic activity and interest spreads. We believe they help us to understand and anticipate changes in the economic cycle. Our method forces us to accumulate cash as the indicators anticipate a recession and reduces the cash position as the indicator anticipates a recovery.

- Our second predictive factor is an analysis of fundamental valuations.

- Our third factor is technical and is used to determine the relative attractiveness of all asset classes including cash.

Our portfolio strategies may migrate over time becoming defensive when conditions warrant. Likewise, as conditions improve our exposure to risk assets may increase in our portfolio strategies.

DISCLOSURES

- There are no guarantees that any of the objectives stated herein will be achieved.

- The views expressed by Carlos Dominguez are his own and do not necessarily reflect the opinion of Raymond James or its Affiliates.

- Past performance is no guarantee of future results

- An index is not managed and is unavailable for direct investment

- Asset allocation and diversification do not guarantee a profit or protect against losses.

- The PIM program is not designed to be excessively traded or for inactive accounts and may not be suitable for all investors. Please carefully review the Raymond James advisory disclosure document for a full description of our services. The minimum account size for these programs is $50,000.

- Since no one investment program is suitable for all types of investors, this information is provided for informational purposes only. You should review your investment objectives, risk tolerance and liquidity needs before selecting a suitable investment program.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC

620 Spring Street SE

Gainesville, GA 30501

678-971-1337

Investing involves risk and you may incur a profit or loss regardless of strategy selected. Alternative investments are available only to those who meet specific requirements, including minimum net worth tests. Please review any offering materials carefully, and consult with your tax advisors prior to investing. There are special risks involved with alternative investments, including investment strategies, and different regulatory and reporting requirements. There can be no assurance that any investment will meet its performance objective. Futures trading is speculative, leveraged, and involves substantial risks. Commodities and currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations event during periods when prices overall are rising.